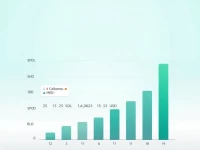

Swazi Lilangeni SZL Faces Volatility Against USD Amid Market Shifts

This article explores the exchange rate dynamics of the Swiss Franc (SZL) against the US Dollar (USD), providing the latest exchange rate data up to August 11, 2025, and comparisons with other major currencies. It also discusses the potential opportunities and trends for investors in the foreign exchange market.